The Base Protocol (BASE)

Rebasing is a powerful innovation. However, most rebase projects haven’t utilized this innovation for its highest potential. Rather, these projects have simply facilitated DeFi money games that don’t create fundamental value. The purpose of this article is to make one thing clear — Base Protocol is not one of those projects.

BASE is a token whose price is pegged to the total market cap of all cryptos. This gives traders the ability to speculate on the entire crypto industry as though it were an index like the S&P 500 or NASDAQ.

The Base Protocol (BASE) is a synthetic crypto asset whose price is pegged to the total market cap of all cryptocurrencies at a ratio of 1 : 1 trillion. BASE allows traders to agnostically invest in the entire crypto industry with one token.

● If crypto market cap is $350B, BASE is $0.35.

● If crypto market cap is $700B, BASE is $0.70.

How It Works

● syn·thet·ic /sinˈTHedik/

A synthetic asset is one whose properties have the same effect and value as another asset. BASE is a synthetic asset engineered to simulate the market patterns of its underlying asset – all cryptocurrencies. This allows users to agnostically speculate on every token, rather than just one or a select portfolio of multiple.

● e·las·tic/əˈlastik/

BASE is built on an elastic supply protocol which programmatically expands/contracts token supply to achieve target price equilibrium. BASE’s target price is one trillionth the total market capitalization of all cryptocurrencies: (cmc) x 0.1^12. When BASE market price (bmp) = (cmc x 0.1^12), BASE is at equilibrium. When this equilibrium is disrupted, token supply is adjusted.

● re·base/rēˈbās/

Supply expansions / contractions are called rebases.

Rebases occur when bmp ≠ (cmc x 0.1^12).

When bmp > (cmc x 0.1^12), expansion rebase occurs.When bmp < (cmc x 0.1^12), contraction rebase occurs. Expansion creates new supply, decreasing scarcity and driving price down its target. Contraction destroys supply, increasing scarcity and driving price up to its target.

● cas·cade/kaˈskād/

Users will be able to buy BASE at its Uniswap liquidity pool. The Base Cascade rewards users who stake their BASE in the liquidity pool. The Cascade issues rewards based on how long a user stakes their tokens in the pool – where the more liquidity provided, and for longer, the greater share of the pool they receive.

Use Cases

Crypto Index/ˈinˌdeks/

The Base Protocol acts as a one-stop trading instrument which allows holders to speculate on the entire crypto industry simultaneously, rather than just one token or a select portfolio of multiple. This should be valuable for outsiders interested in crypto investing who don’t know which assets they “should” buy. It will also be useful for institutional investors seeking to diversify crypto exposure to the entire industry, and general crypto traders looking to hedge or diversify their investments.

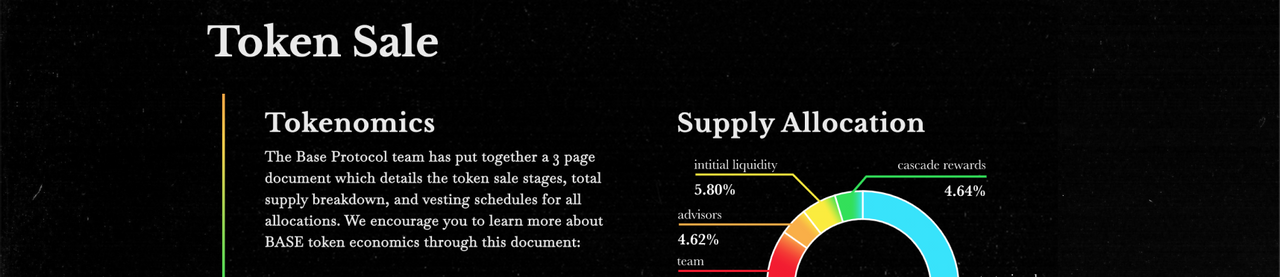

Token Sale Tokenomics

The Base Protocol team has put together a 3 page document which details the token sale stages, total supply breakdown, and vesting schedules for all allocations. We encourage you to learn more about BASE token economics through this document:

Token Economics

Total Token Supply : 8,493,221 BASE

This is the total supply of BASE tokens at the time of launch.

Initial Circulating Supply : 1,859,548 BASE

Most tokens sold in the fundraise and allocated for the ecosys-

tem are locked/vested, so the initial circulating supply of BASE

is less than 25% of total supply. The Base Protocol fundraise is

set up to only allow investors who demonstrate strategic value

and a long-term interest in the future of the project.

Initial Market Cap at List Price : $650,842

We’ve put a lot of consideration in structuring the project bud-

get to keep the total raise limited and the initial market cap as

low as possible, while still raising enough for a properly funded

launch and at least three years of runway.

Initial Liquidity : 492,424 BASE

These tokens (5.8% of supply) are allocated for initial Uniswap

liquidity. These tokens are matched with an equal value of ETH

recieved in fundraising, equating to $344,696 in liquidity at

launch.

Token Economics

Operational Reserves 46% Supply

Ecosystem | 21.80% | 1,851,516 BASE

BASE tokens reserved for future ecosystem objectives like

partnerships, marketing, exchange listings, hiring, etc.

• Tokens vested over 36 months

• 2.77% released instantly

• 2.78% released monthly

Team | 9.30% | 789,798 BASE

BASE tokens reserved for the Base Protocol team. Team tokens

are locked and vested to demonstrate long-term commitment.

• Tokens locked for 12 months

• After lockup, tokens are vested over 12 months

• 9.09% released monthly

Advisors | 4.62% | 392,019 BASE

BASE tokens reserved for the Base Protocol advisory board.

These tokens are vested to demonstrate long-term commitment.

• Tokens vested over 12 months

• 8.33% released instantly

• 8.33% released monthly

Initial Liquidity | 5.80% | 492,424 BASE

BASE tokens immediately deployed on Uniswap to provide

initial liquidity at launch.

• 100% of tokens released instantly

• 100% of tokens deployed to liquidity pool

• Total liquidity at launch : $344,696

Initial Cascade Rewards | 4.64% | 393,940 BASE

BASE tokens allocated for the game-changing liquidity staking

rewards program: the BASE Cascade. This is a “launchpad”

allocation. The BASE Cascade replenishes itself at every rebase,

making it a uniquely self-sustaining liquidity staking program.

The initial Cascade rewards are a provisional allocation to in-

centivize early adoption for liquidity staking.

• Tokens reserved and not circulating until Cascade launch

• Tokens deployed into Cascade rewards pool after the first

Base Protocol rebase

Team

Conclusion

In its early stages, a synthetic rebase token – whose goal is to peg to the price of an underlying asset – is mostly speculative. That speculation is derived from sentiment that the asset will eventually serve its function. That function- ality directly depends on general acceptability – in other words, adoption. And until a popular adoption threshold is met, the asset is susceptible to refractory lag, freeze, and volatility.

To get clearer information, please visit the link below:

● Website: https://www.baseprotocol.org/

● ANN Thread: https://bitcointalk.org/index.php?topic=5283589.0

● Twitter: https://twitter.com/baseprotocol

● Telegram: http://t.me/baseprotocol

● Discord: https://discord.gg/rsPCcYV

● Medium: https://medium.com/@BaseProtocol

● Youtube:

https://www.youtube.com/channel/UCfiacHaKd98kNLSRbc-4qnw

● WhitePaper: https://drive.google.com/file/d/1O9V4vjygGmno90NAXSDtj9IwZAelZCsj/view

● Presale Application:

https://www.baseprotocol.org/presale

AUTHOR

Bitcointalk Username: Dewi08

Telegram Username: @ dhewio8

Bitcointalk url: https://bitcointalk.org/index.php?action=profile;u=894088

Wallet address (eth): 0x53D1Ea8619E638e286f914987D107d570fDD686B