The Base Protocol

The Base Protocol (BASE) is a synthetic crypto asset that derives its price from the total market cap of all cryptocurrencies (cmc) at a ratio of 1 : 1 trillion. BASE exists to maintain a market rate that is stably pegged to its underlying asset – the crypto industry. BASE’s peg to cmc is held stable through an elastic supply protocol.

Crypto Index

The Base Protocol acts as a one-stop trading instrument which allows holders to speculate on all cryptocurrencies simultaneously, rather than just one or a select portfolio of multiple. It allows traders to agnostically invest in the entire crypto ecosystem. This is its primary function.The Base Protocol can also be used as a tool for more nuanced trading situations:

Save Haven

BASE can be used as a transitory, “save haven” position between crypto transactions. Typically, one might trade into a “blue chip” crypto to reduce risk exposure, or trade into a stablecoin to remove risk exposure. Trading into BASE presents an alternative that maintains exposure to all cryptocurrencies rather than just one. This could be riskier than trading into a blue chip, but in some instances, may act as a hedge against some isolated / unforeseen events. For example, a rapid downfall in the blue chip, or the rapid emergence of a new project.

Trading into BASE mitigates the inherent risk of holding one coin, while absorbing the potential gains of several others. So far, the most popular safe haven crypto asset is Bitcoin, as it generally leads industry direction and is historically the least volatile.

The ability to “hold” the entire crypto market should present a useful trading alternative.

Price Reference

Another use case is for BASE to function as a price reference for all cryptocurrencies. If a trader is speculating on an altcoin (x), he will often track price in terms of x/BTC rather than x/USD. This price reference illustrates how x performs relative to BTC rather than USD, which is the more important data for many crypto traders. If the trader instead uses x/BASE as their price reference, it would illustrate how x performs relative to the overall crypto market, rather than just BTC. The x/BASE price reference should present a valuable alternative to the popular x/BTC price reference.

Lending Instrument

BASE can also be used as a lending instrument to hedge on leveraged crypto trading. Traditionally, lending has been a challenge in crypto; if an individual borrows 1 BTC to buy a car, they could be on the hook for much more than they originally borrowed when it’s time to pay that 1 BTC back.

This volatility presents a problem in borrowing crypto for general purposes, but can be useful if borrowing for crypto investing. Say a trader borrows 100 BASE to buy an altcoin, and that the altcoin plummets alongside a bearish trend in the crypto markets. When the trader goes to pay their 100 BASE back to the lender, he notices the value of that BASE also dropped – perfectly correspondent to the crypto market. This means that when he pays the loan back, he only absorbs the loss he took that was in excess of the overall loss in the market.

And vice versa, if his altcoin went bullish, he would only absorb the gain in excess of overall market performance. In this way, BASE can be used as a strategic hedging instrument for crypto-focused portfolios trading on leverage.

Synthetic Assets

“Synthetic is the term given to financial instruments that are engineered to simulate other instruments while altering key characteristics. There are many different reasons behind the creation of synthetic positions. A synthetic position, for example, may be undertaken to create the same payoff as a financial instrument using other financial instruments.

Synthetic positions can allow traders to take a position without laying out the capital to actually buy or sell the asset. A synthetic is an investment that is meant to imitate another investment.” (Chen, 2019)

Derivatives (such as futures or options) are the most common form of a synthetic asset. However, not all synthetics are derivatives – it is important to understand the difference.

Elastic Supply

BASE is a synthetic asset that functions to reflect the “price” of all cryptocurrencies. BASE derives its target price (tp) directly from the total market cap of all cryptocurrencies (cmc) at a rate of 1 : 1 trillion, or cmc x 0.112 :

tp = cmc x 0.112

For example, assume cmc = $500,000,000,000

tp = (500,000,000,000 x 0.112)

Target price is $0.50.

The Base Protocol functions to ensure that BASE market price (mp) is equal to target price (tp).

When

market price (mp) = target price (tp)

BASE is in a state of equilibrium.

Its price perfectly reflects cmc.

When

market price (mp) ≠ target price (tp)

BASE is in a state of disruption.

Its price does not perfectly reflect cmc.

Rebasing

At the highest level, a rebasing protocol exists to do one thing: correlate a synthetic asset’s price perfectly with the price of its underlying asset. This is achieved by adjusting the synthetic asset’s supply until its market price (mp) reaches its target price (tp), the price at which the synthetic asset is at equilibrium with its underlying asset.

Consider this example, where tp = $1:

t1 : Starting Equilibrium

John has 1 BASE worth $1.

t2 : Price Increases

John has 1 BASE worth $2.

t3 : Ending Equilibrium

John has 2 BASE each worth $1.

Programming

Base Protocol code is open-source and accessible at the Base Protocol GitHub.

https://github.com/base-protocol

The Base Foundation may add technical programming details to this section if deemed necessary in the future.

Data Sourcing

For the Base Protocol to achieve its price peg, it requires one key data point: the total market cap of all cryptocurrencies (cmc). At launch, 11 off-chain cryptocurrency data APIs will be polled at regular intervals for market cap information by a quorum of Chainlink oracles operated by the Base Protocol team.

The Chainlink oracles calculate the median value of cmc across those 11 providers. The median is used rather than the average so as to better protect against extreme outlier values reported by any of these APIs, whether erroneously or maliciously.

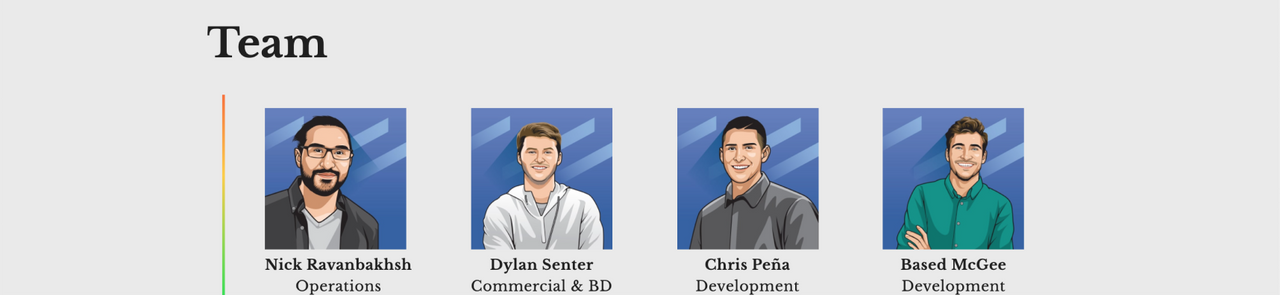

Team

Conclusion

In its early stages, a synthetic rebase token – whose goal is to peg to the price of an underlying asset – is mostly speculative. That speculation is derived from sentiment that the asset will eventually serve its function. That function- ality directly depends on general acceptability – in other words, adoption. And until a popular adoption threshold is met, the asset is susceptible to refractory lag, freeze, and volatility.

To get clearer information, please visit the link below:

● Website: https://www.baseprotocol.org/

● ANN Thread: https://bitcointalk.org/index.php?topic=5283589.0

● Twitter: https://twitter.com/baseprotocol

● Telegram: http://t.me/baseprotocol

● Discord: https://discord.gg/rsPCcYV

● Medium: https://medium.com/@BaseProtocol

● Youtube:

https://www.youtube.com/channel/UCfiacHaKd98kNLSRbc-4qnw

● WhitePaper: https://drive.google.com/file/d/1O9V4vjygGmno90NAXSDtj9IwZAelZCsj/view

● Presale Application:

https://www.baseprotocol.org/presale

AUTHOR

Bitcointalk Username: Dewi08

Telegram Username: @ dhewio8

Bitcointalk url: https://bitcointalk.org/index.php?action=profile;u=894088

Wallet address (eth): 0x53D1Ea8619E638e286f914987D107d570fDD686B