what is Stater?

Stater is an open-source peer-to-peer lending platform for NFT assets.

At Stater, we are building an open-source p2p lending platform that will help users unlock the value of their NFT assets without losing ownership. Our main goal is to bring DeFi into the NFT market and help users unlock over $100m worth of digital assets. The Stater lending platform will be non-custodial and will have two main ways for facilitating transactions between lenders and borrowers: marketplace lending and pool lending. In both options, Stater will act as a non-custodial escrow between lenders and borrowers.

Market Overview

The NFT market has seen amazing growth in 2020 by surpassing 100m in lifetime sales and the overall market is still in its early stage if we look at the actual potential that we see in specific markets that already have traction like gaming and art or promising use cases like real estate.

If we take a look at what works today, we see promising traction in gaming, art and virtual real estate.

In gaming, the global market is expected to generate over $159 billion in sales in 2020 and most of the sales will be done through in-game purchases. NFTs are promising in this space because they can provide users with true ownership over their in-game assets and creators have the possibility to build micro-economies that can generate real world value inside their games.

In art, we can see a digital renaissance taking place today, where creators can instantly expose their works directly to the market without the need for a 3rd party that would naturally create a barrier to entry and eat up revenue from creators through fees.

Stater Lending Platform Overview

At Stater our goal is to build an P2P open-source lending platform for NFT digital assets that can provide a seamless experience for borrowers and lenders alike.

In the first version that we are expecting on launching in December 2020, the lending process will have an approach that will be marketplace-driven at the beginning with improvements that will automate the process even more in the future.

Key features of our product:

Marketplace lending system

liquidity providers will be able to provide loans to the most attractive packages.

Bundle option available

borrowers are able to use multiple assets as collateral in order to increase the value of their loan package.

Collateral locked in smart contract

with the option to withdraw the assets if the borrower didn’t received a loan or after full repayment of the loan.

Lenders receive the collateral in case of liquidation

in the scenario where the borrower doesn’t repay the full amount of the loan, the lender will have the option to call the loan and take the collateral into his custody.

How will it work?

Borrowers

will list their NFT asset on the stater marketplace by specifying the asset value, loan duration and borrow amount (that will be derived from the loan to value ratio). Borrowers have the option to borrow with one or multiple assets (bundle).

Lenders

will see all the listed assets from all the borrowers inside the marketplace and will have the option to easily provide loans to the packages that they find attractive. They will also see specific game and asset information that will help during the due diligence process and be able to filter specific loan parameters in order to find the best loan opportunities inside the marketplace.

Stater Platform

will mainly act as an escrow for the entire duration of the loan. After the borrower submits the asset on the platform, the NFT token will be locked in a smart contract inside the platform. The borrower can always claim his NFT if the asset has been listed on the marketplace but it hasn’t received a loan yet or if he has fully completed the repayment of the loan.

Liquidation Practices

in the scenario where the borrower doesn’t repay the loan on time or at all, the lender will have the option to call the loan and receive the asset in his custody.

Risk Mitigation for Lenders

we believe that there are three key components that will help lenders properly asses and manage risk: asset value, LTV ratio and game/asset market data.

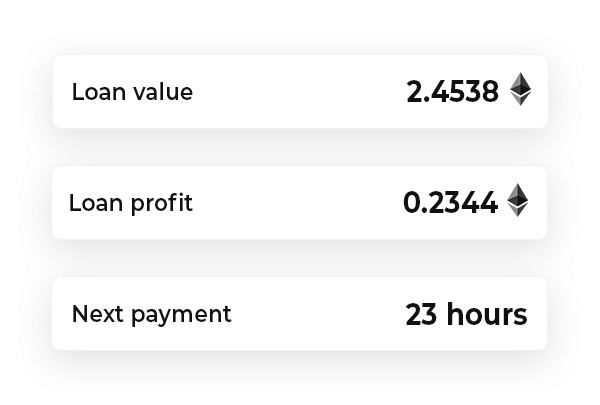

Borrow by using your favourite NFT assets as collateral

Stater is a P2P lending and borrowing platform that allows users to leverage their NFT assets and have access to liquidity while still retaining ownership of their digital assets. We provide value to previously latent capital, unlocking wealth within digital assets and providing a new source of money creation.

- From 0.2 ETH

- Up to 50% LTV

- Interest from 7.9% APR

The NFT market has seen amazing growth in 2020 by surpassing 100m in lifetime sales and the overall market is still in its early stage if we look at the actual potential that we see in specific markets that already have traction like gaming and art or promising use cases like real estate. If we take a look at what works today, we see promising traction in gaming, art and virtual real estate.

Without Stater NFT the following fees will apply by default on our platform:

- 40% from interest rate

- 1% from loan amount

There will be 2 types of Stater NFTs with different discount rates: Stater Founder’s Edition and Stater Community Edition.

By staking Stater Founder’s Edition on our platform, the following fee reductions will apply:

- 50% from interest rate

- 50% from loan amount

By staking Stater Community Edition, the following fee reductions will apply:

- 15% from interest rate

- 15% from loan amount

Besides reduction in fees on our platform, Stater NFT owners will also receive community airdrops and other exclusive perks in our ecosystem.

Lend with maximum flexibility

Stater is a marketplace driven lending platform that provides lenders the option to pick and chose their best investments with available due diligence for risk mitigation. Pool lending is also available for a faster lending process with less friction.

- Provide liquidity on marketplace

- Participate in a lending pool

STTR Token Information

- Contract address: 0x2D30932A5220Fc06423C52Cb35364316B3184fb5

- Token Symbol: STTR

- Decimals: 18

- Total supply: 10,000,000,000 STTR

STTR Price and Market Cap

- 1 ETH = 100,000 STTR tokens

- 1 STTR = 0.00001 ETH

- Initial market cap target: $60m

STTR Token Utility

With STTR, users will have a new range of possibilities in our ecosystem.

- Fee Discount: Stake STTR and receive 5% discount from interest rate and 5% from loan amount.

- Borrow STTR: Create a borrow package and receive your loan in STTR.

- Lend STTR: Offer loans in STTR to borrowers that have this option enabled.

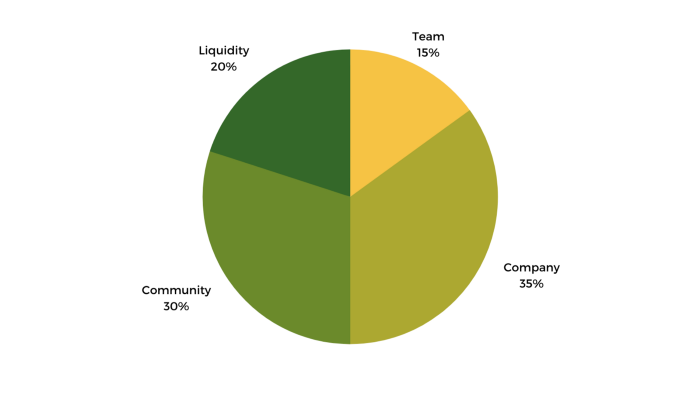

STTR Token Allocation:

15% team with 24mo vesting schedule.

35% company with 24mo vesting schedule. The pool will be used to cover operational costs and hiring new people.

30% community with 12mo vesting schedule. Our goal with this pool is to be fully owned by the community. The tokens will be used for development grants and bounties.

20% liquidity mining with no vesting schedule for 12mo. This pool will be used to incentivize market making on Uniswap.

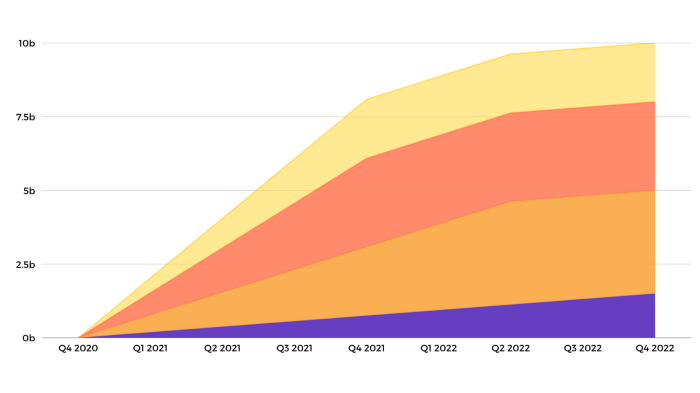

Vesting Schedule

The below chart showcases the vesting schedule for team, company and community tokens.

CONCLUSION

we believe that a marketplace approach is the best solution at the beginning and it will remain so for rarer assets that have a high intrinsic value and lower market volume.

In the meantime, feel free to check out our website: https://stater.co/

Where can we get in touch?

Whitepaper: https://drive.google.com/file/d/1m9FpIUrsCnkYsI1s5ltKPBO-sKaKJsAO/view?usp=sharing

Website: https://stater.co

Discord: https://discord.gg/hBGgjhe

Telegram: https://t.me/staterlending

Medium: https://medium.com/@staterco

Product Preview: https://youtu.be/Fcm-_v-50kE

AUTHOR

Bitcointalk Username: Dewi08

Telegram Username: @ dhewio8

Bitcointalk url: https://bitcointalk.org/index.php?action=profile;u=894088

Wallet address (eth): 0x53D1Ea8619E638e286f914987D107d570fDD686B